Main customers and business partners

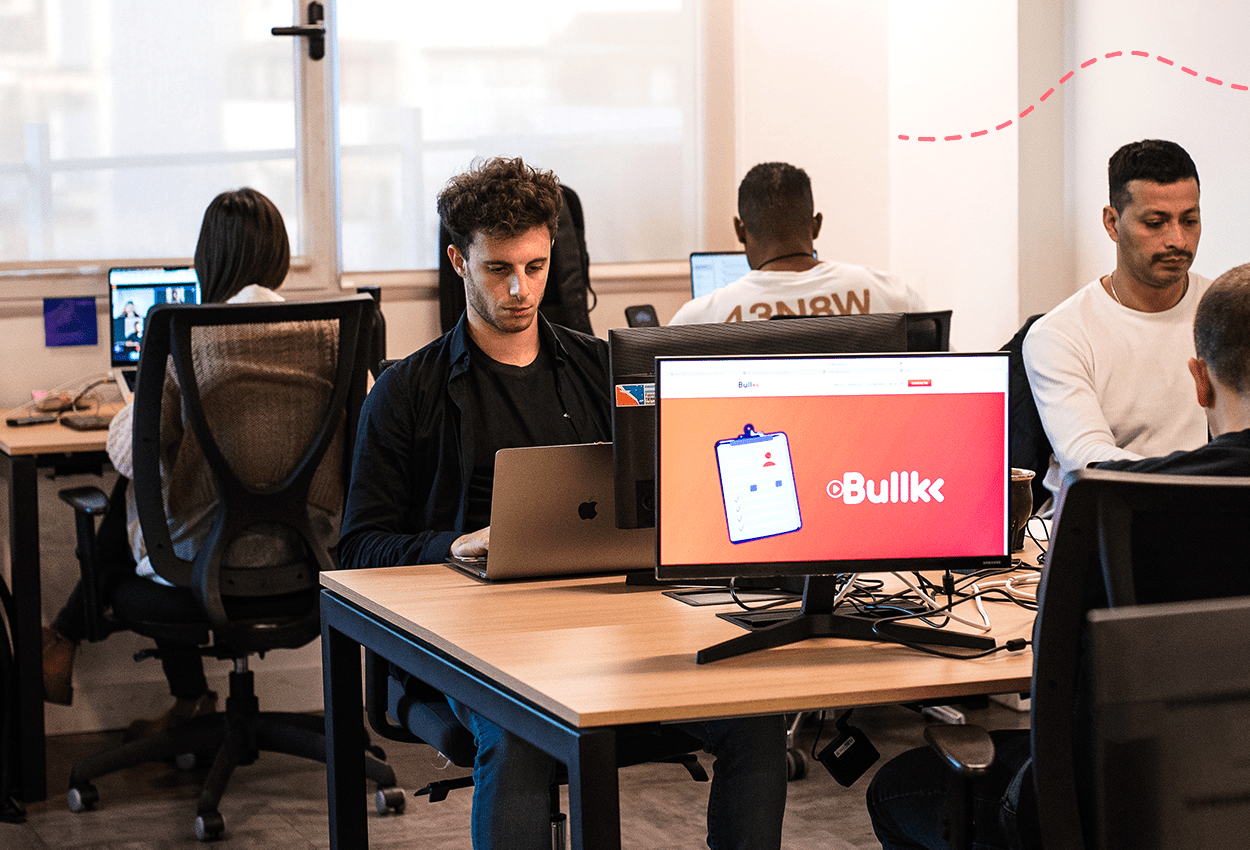

About us

We are a startup with a unique philosophy. We rely on your behavior to assess your trustworthiness. If we can demonstrate it, financial institutions will place more faith in you.

With our Payment Profiling Predictive Model (PPM), we assist you in showcasing your reliability to lending institutions. You'll obtain a comprehensive credit profile, enhancing your appeal to them and facilitating access to better credit offers.

How do we do that?

Discover how we develop your Payment Profiling Predictive Model (PPM)

How do we do that?

1.

Sociodemographic

Footprint

We gather data and variables on age, gender, geolocation, and marital status.

2.

Credit History

Footprint

We analyze the age of your credit history, quantity and types of claims, and payment behavior.

3.

Transactional

Footprint

We monitor your daily operations on financial institution platforms.

4.

Digital Footprint

We assess behavior and insights in digital applications.

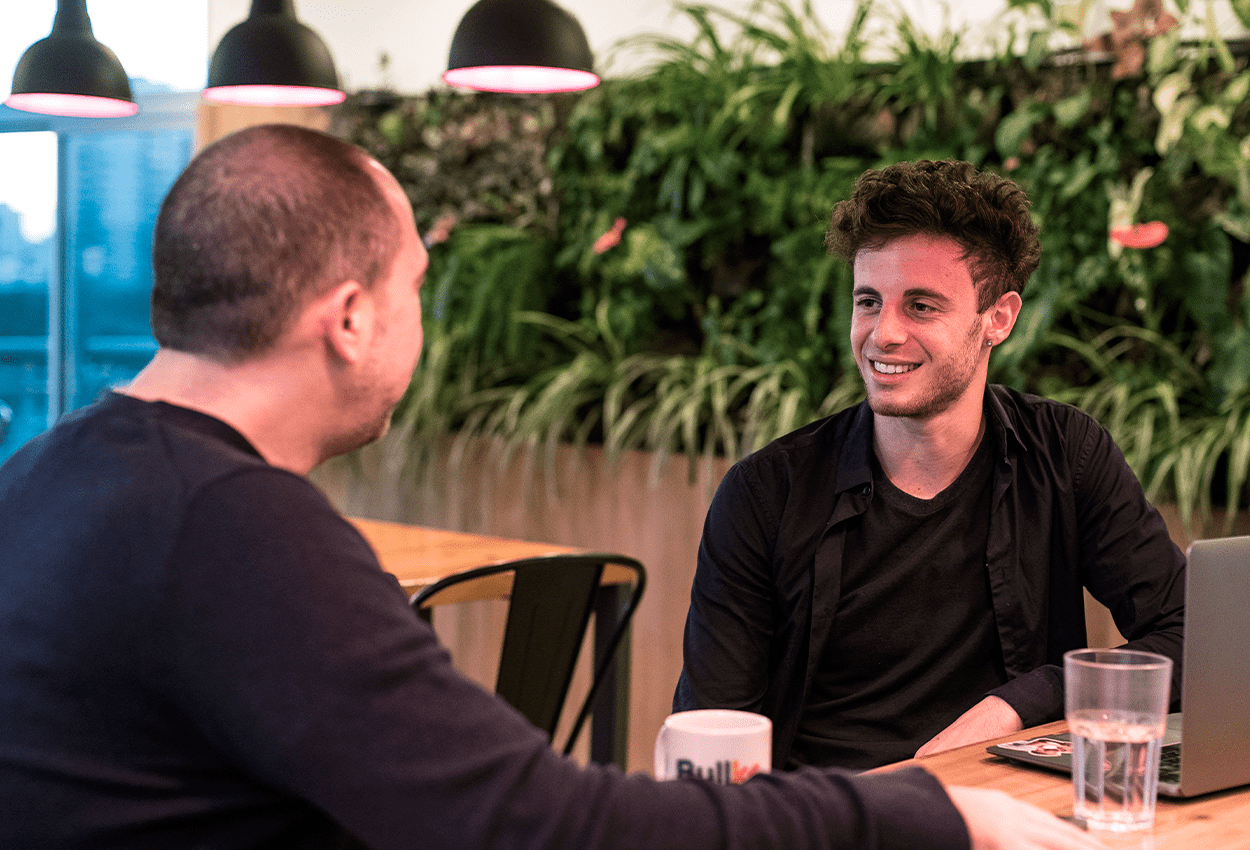

Testimonies

Juan Luis Solana

Credit manager

María Diez de Fernández

Housewife

Mario Bogado

Plumber

Bullk Services on Forbes

“Bullk Services, by Gumery our axes, fostering greater trust between financial institutions and their users”.

Available in: México | Colombia | Chile | Perú | Centroamérica

“Bullk Services, by Gumery our axes, fostering greater trust between financial institutions and their users”.

Available in: México | Colombia | Chile | Perú | Centroamérica

Main customers and business partners

Location

Dr Luis Bonavita #1294 Torre II, Oficina 1901 - WTC – Montevideo Uruguay CP 11300

Bullk Services By Gumery

Somos una startup con una filosofía única.

- Operated by Gumery SA

- Marketed by Bullk Services LLP